SpyCloud

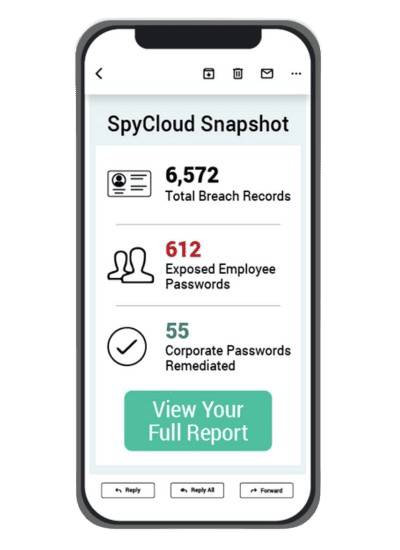

SpyCloud delivers Cybersecurity solutions that transform data from underground criminal ecosystems into actionable intelligence that reduces your organisation’s cyber risk. Using specialised technology to collect, normalise and analyse data from criminal networks, SpyCloud helps enterprises prevent Account Takeover (ATO), data breaches, online fraud and other identity-driven attacks. It continuously monitors the dark web and malware-stealer logs to identify exposed credentials and personal data before criminals can weaponise them.

SpyCloud protects a broad range of customers – from Fortune 500 organisations and leading financial institutions to mid-size businesses and government agencies worldwide. Headquartered in Austin, Texas, SpyCloud’s team of more than 150 security experts is dedicated to making the internet a safer place for businesses and consumers.

With over six years of focused research, SpyCloud has invested heavily in decrypting and analysing exposed data, achieving the ability to recover more than 90% of passwords in plaintext and link them to rich identity information. This gives organisations deep, real-world insight to stay ahead of cyber attacks, strengthen their security posture and design modern, proactive defence strategies.

Process

SpyCloud maintains one of the largest repositories of breach and malware-derived data in the industry, collected from the darknet and criminal communities. This data powers solutions that protect against ATO, ransomware, session hijacking and online fraud. The Cybercrime Analytics Engine does far more than store data – every digital asset is validated, cleansed and enriched to maximise its value. SpyCloud removes noise, cracks passwords, enriches identities and correlates data across multiple breaches to build accurate digital profiles. The result is high-quality, high-context intelligence that integrates with your existing security stack and enables fast, decisive action against cyber attacks.

Human intelligence combined with automated tooling builds one of the world’s largest collections of cybercrime data from underground sources. SpyCloud uncovers hidden patterns, emerging trends and active threats that traditional tools simply cannot see – laying the foundation for a safer digital future.

SpyCloud normalises and standardises billions of unstructured records into machine-readable, trustworthy data. By aggressively removing noise and duplicates, the engine converts raw breach dumps and malware logs into a clean, searchable corpus that security teams can actually use.

Beyond cracking passwords, SpyCloud enriches every record with additional context – such as related identities, malware indicators and associated devices. This reveals the severity and business impact of each exposure and allows organisations to prioritise remediation efforts intelligently.

The engine correlates and scores exposures to build a unique, accurate risk picture for each identity. It uncovers hidden links between accounts, sessions and devices, enabling security teams to detect high-risk users and active attacks with precision and speed.

SpyCloud intelligence is delivered through the Cybercrime Analytics platform, developer-friendly APIs and integrations with leading security tools. This allows organisations to automate protection of digital identities, embed cybercrime intelligence into existing workflows and block attackers who rely on stolen data to impersonate employees or customers.

Even as organisations increase budgets for cybersecurity and fraud prevention, adopt threat intelligence platforms, EDR tools, phishing detection and anti-fraud controls, over 90% of organisations worldwide were still impacted by ransomware attacks in the past year.

Cyber threats spread like wildfire. Criminals impersonate government officials, law enforcement, bank employees and delivery companies to build trust. They use tactics such as fake customs notifications, “must-pay” fees to avoid prosecution, and high-value prize scams that require upfront taxes or service charges. Identity fraud continues to rise, while large-scale data breaches remain alarmingly frequent.

Experts in cybersecurity and fraud prevention agree: traditional security controls alone are no longer enough to deal with the sophistication of modern cybercrime. Without proactive intelligence on exposed identities and attacker behaviour, the economic, market and social impact of these threats will only grow.

Reduce Risk – Reduce breach and ransomware risk by continuously monitoring for exposed employee identities, whether leaked through third-party data breaches or malware infections. Early detection and rapid remediation of compromised accounts prevents unauthorised access and strengthens your overall cybersecurity posture.

Prevent Targeted Attacks – Prevent targeted ransomware, ATO and session hijacking by invalidating access based on stolen credentials and cookies. Ongoing monitoring and automated response reduce the window of opportunity for attackers, protecting critical data and business continuity.

Shorten Response Times – Accelerate incident response with automation integrated into Active Directory and other security systems. Automatically identify and remediate compromised accounts, reset exposed passwords and revoke active sessions – reducing the workload on your IT and security teams while improving resilience against cyber threats.

Enterprise Protection | Consumer Fraud Protection | Investigations

Protect your organisation from credential-driven attacks and ransomware without adding headcount by continuously monitoring and remediating exposed employee identities.

Automatically detect and reset exposed Windows credentials, harden your AD environment and reduce the risk of lateral movement and privilege escalation.

Prevent unauthorised access to critical employee services, including corporate SSO, by invalidating stolen session cookies and risky logins in real time.

Assess ATO risk across your supply chain and share intelligence with partners to coordinate remediation and reduce ecosystem-wide exposure.

Provide your highest-risk executives and VIPs with enhanced protection for their online identities across both corporate and personal accounts.

Reduce consumer account takeover by detecting and resetting compromised credentials at scale, before criminals can use them for fraud or abuse.

Detect consumer risk for ATO, synthetic identities and malware-linked fraud using behavioural and exposure-based risk scoring.

Protect user identities during live sessions with applications by detecting and invalidating stolen session artefacts used by attackers to bypass authentication.

Integrate intelligence with investigation tools such as Maltego and Jupyter Notebook to visualise and correlate critical links across identities, devices, sessions and threat actors.

Detection & Monitoring – Protect employee digital identities by continuously monitoring for exposed credentials and PII. Enhance your cybersecurity posture by detecting, recovering and managing compromised data quickly, closing blind spots in your ransomware defence. Monitor unauthorised access to business applications and schedule Active Directory scans to identify weak or exposed passwords.

Prevention & Protection – Reduce enterprise risk through automated controls that block costly cyber attacks. Prevent data loss by resetting compromised passwords, invalidating stolen sessions and enforcing strong password policies. Optimise CapEx/OpEx by redirecting resources from manual triage to strategic initiatives while preventing attackers from bypassing authentication on trusted devices and evading traditional defences.

Response & Remediation – Speed up security incident response with automated remediation. Streamline SOC workflows through SIEM/SOAR integrations and high-fidelity alerts. Prioritise investigations based on real compromise evidence, minimise the attack surface by invalidating live sessions and reduce risk across users, applications and devices.

SpyCloud Consumer Risk Protection is a cybersecurity solution designed to protect digital identities of your customers. It leverages underground intelligence and dark web monitoring to detect risk from account takeover (ATO) and session hijacking. Integrating SpyCloud into your fraud and security workflows increases protection, reduces risk and delivers a smoother, low-friction user experience.

With actionable intelligence such as exposed credentials, stolen passwords and compromised personal information (PII), SpyCloud enables organisations to enforce stronger passwords, prevent credential reuse and detect malware-infected consumers. This helps prevent cyber attacks, reduce data theft and strengthen digital trust across your customer base.

SpyCloud also helps defend against advanced attacks such as authentication bypass and the use of stolen session cookies to log in without passwords. By analysing malware-stealer logs and browser fingerprints, the platform identifies compromised consumers and alerts your organisation in near real time – enhancing fraud prevention and raising the security bar for customer accounts.

Anticipate Account Takeover (ATO) – Identify users at high risk of ATO based on exposed credentials, weak passwords and other risk indicators. Being able to predict and prevent account takeover is critical in an era where cyber threats are increasingly complex and fast-moving.

Detect Synthetic Identities – Detect synthetic identities by identifying anomalies in user data that suggest fake, stolen or artificially constructed profiles. This reduces fraud loss, protects credit portfolios and boosts confidence in digital onboarding and account opening.

Forecast Targeted Attacks – Use third-party data breach intelligence to generate real-time alerts on users whose data has been newly exposed, making them high-value targets for cybercriminals. This helps security and fraud teams prioritise controls and manage cybersecurity risk more effectively.

Predict Malware-Linked Fraud – Identify consumers whose data has been stolen via malware, including device fingerprints and browser artefacts used in fraud. Early detection enables rapid response to reduce data theft, prevent fraudulent transactions and enhance digital identity protection.

A Fortune 100 financial services provider uses SpyCloud to protect millions of customers worldwide from account takeover (ATO) driven by large-scale data leaks. SpyCloud’s deep cybercrime intelligence enables their Threat Intelligence team to correlate data that previously seemed unrelated – dramatically improving fraud investigations and decision-making.

Identifying the true perpetrators behind fraud and enabling law enforcement action requires high-quality external threat intelligence. SpyCloud aggregates data from multiple underground sources, including the dark web, and enriches it to deliver accurate, trustworthy indicators. This allows enterprises and law enforcement agencies to collaborate more effectively and disrupt organised cybercrime.

Cybercrime Analytics powered by SpyCloud has become a critical layer of defence for financial institutions and other high-risk industries. By combining real-world breach data, proactive monitoring and automated prevention, SpyCloud helps organisations stay ahead of attackers, protect digital assets, maintain data integrity and strengthen customer trust. For enterprises in Thailand and across APAC, investing in SpyCloud is a strategic step toward sustainable cyber resilience in the digital era.

As cyber attacks continue to evolve in speed and sophistication, organisations must be prepared to face future threats. The Red Team plays a crucial role in penetration testing and assessing network resilience – simulating real-world attackers to understand how well your organisation can withstand complex cyber assaults.

The Blue Team, on the other hand, focuses on defending the organisation. It collects, analyses and responds to Indicators of Compromise (IoCs), using Cybersecurity and Cybercrime Analytics tools to detect threats early and minimise impact.

When Red Team and Blue Team collaborate closely, we call it Purple Teaming. This combines offensive and defensive perspectives to continuously improve security controls, strengthen processes and build a mature security culture.

Vasvox provides Red & Blue Team services with more than 20 years of experience, modern testing and analytics tools, and comprehensive Cybersecurity Training for your employees. Contact us at 02 138 9199 to strengthen your cyber defence and protect your business in Thailand – securely, sustainably and confidently.

The cyber threat landscape is constantly changing, yet many organisations still rely on legacy tools to fight fast-growing cybercrime. Stopping account takeover (ATO) requires resetting stolen passwords. Preventing session hijacking means invalidating stolen cookies. Blocking ransomware requires disrupting attacks at the earliest stages and closing network gaps. Stopping payment fraud demands strong identity assurance, ensuring that the user behind each transaction is genuine – not a criminal using stolen data. Preventing fraudulent account registrations requires detecting identities constructed from breached data on the dark web.

Cybercrime Analytics gives organisations a new way to prioritise and act on risk. By going beyond traditional threat feeds, it reveals real evidence of compromise, reduces false positives and adds deep context around employee, customer and business exposure – especially where stolen data is being actively used in cyber attacks.

Understanding how your organisation is exposed is the first step toward protecting it. Checking your data breach exposure today can reveal hidden risks across account takeover, ransomware, fraud detection and more. For enterprises in Thailand and worldwide, Cybercrime Analytics – combined with trusted partners like Vasvox and SpyCloud – is a powerful way to strengthen cyber defences, protect digital assets and build long-term trust with customers.